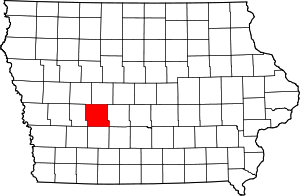

With Election Day only days away, a Guthrie County official breaks down the taxation for the proposed emergency medical services (EMS) ballot measure.

According to Guthrie County Supervisor for District Three Maggie Armstorng explains how the subsidiary funds for how EMS would work is a fairly simple process once people have it down.,

“So you would take your taxable value, which is not your assessed value. It’s different. Your taxable value times 75 cents divided by 1,000, or what we’ve also said is you can do it the same way. Taxable value divided by 1,000 times 75 cent levy.”

Armstrong mentions that this would provide the County with between $750,000 to $800,000 for funding EMS providers that they would be working with, which are Stuart Rescue, Panora EMS and Adair Fire and Rescue. She adds that funds from this levy would only be available for reimbursement payments to the service providers, and can only be used for EMS related expenses, such as medications, equipment, personnel salaries and training for emergency medical technicians and paramedics. The ballot measure needs 60 percent of votes cast by Guthrie County Residents to pass.