There is a special measure on the ballot for the upcoming November 7th city and school board election for eligible voters in the Greene County School District to consider.

The district is asking voters to consider renewing the established Physical Plant and Equipment Levy (PPEL) funds for another ten years. Superintendent Brett Abbotts says voters approved this same measure before and it is a combination of property taxes and income surtax.

“Simply by renewing it there’s no increase, this isn’t anything in addition. But these are highly necessary funds that we use for a lot of different avenues within the school district.”

Abbotts notes the current PPEL rate is $1.01 per $1,000 of taxable valuation and on the ballot the language that is used says the rate can be a maximum of $1.34. However, Abbotts says the highest the school district has been is $1.08 in 2017.

“I made a pledge in our September (School) Board meeting that we would not increase that rate, that we would continue to stay committed over the next at least ten years to continually reduce the overall tax burden on our community members.”

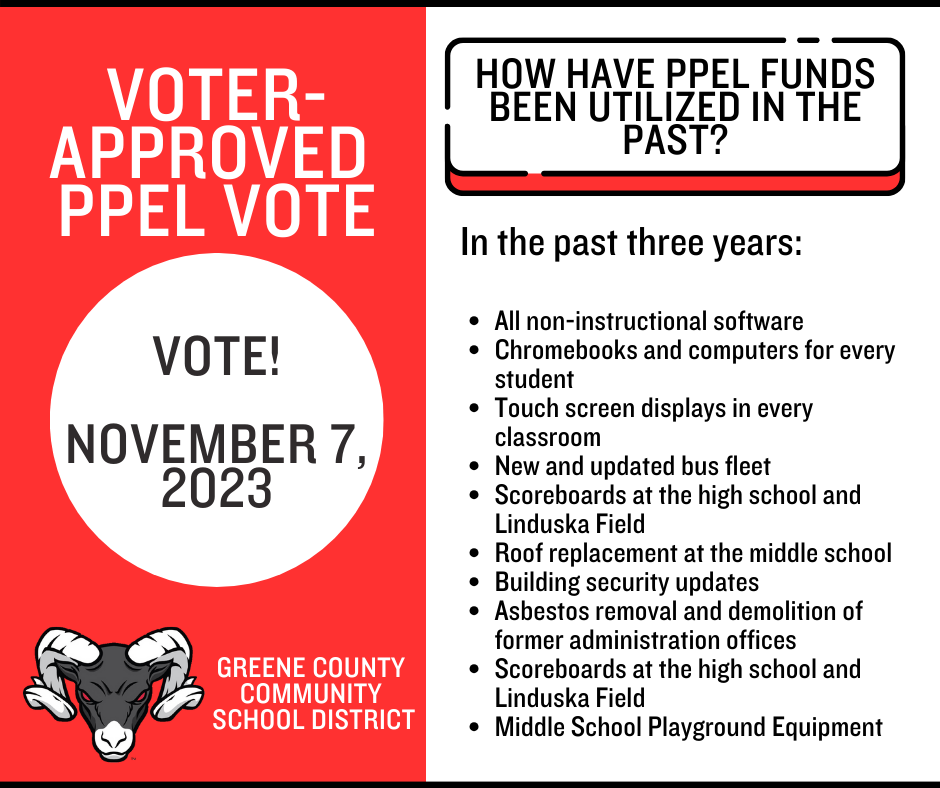

Abbotts explains the current $1.01 per $1,000 of taxable valuation generates about $750,000, which the school district can use on repairs and maintenance of school buildings, transportation purchases, and classroom technology. Recent projects have included a new roof at the middle school, scoreboards at Linduska Field and the high school gym, chromebooks and computers for every student, and new and updated bus fleet, among others. The current PPEL is set to expire next year and if approved by at least 50-percent of the voters, it will be renewed for ten more years.