Guthrie County land valuations for 2019 show a possible eight percent increase in property taxes for 2020.

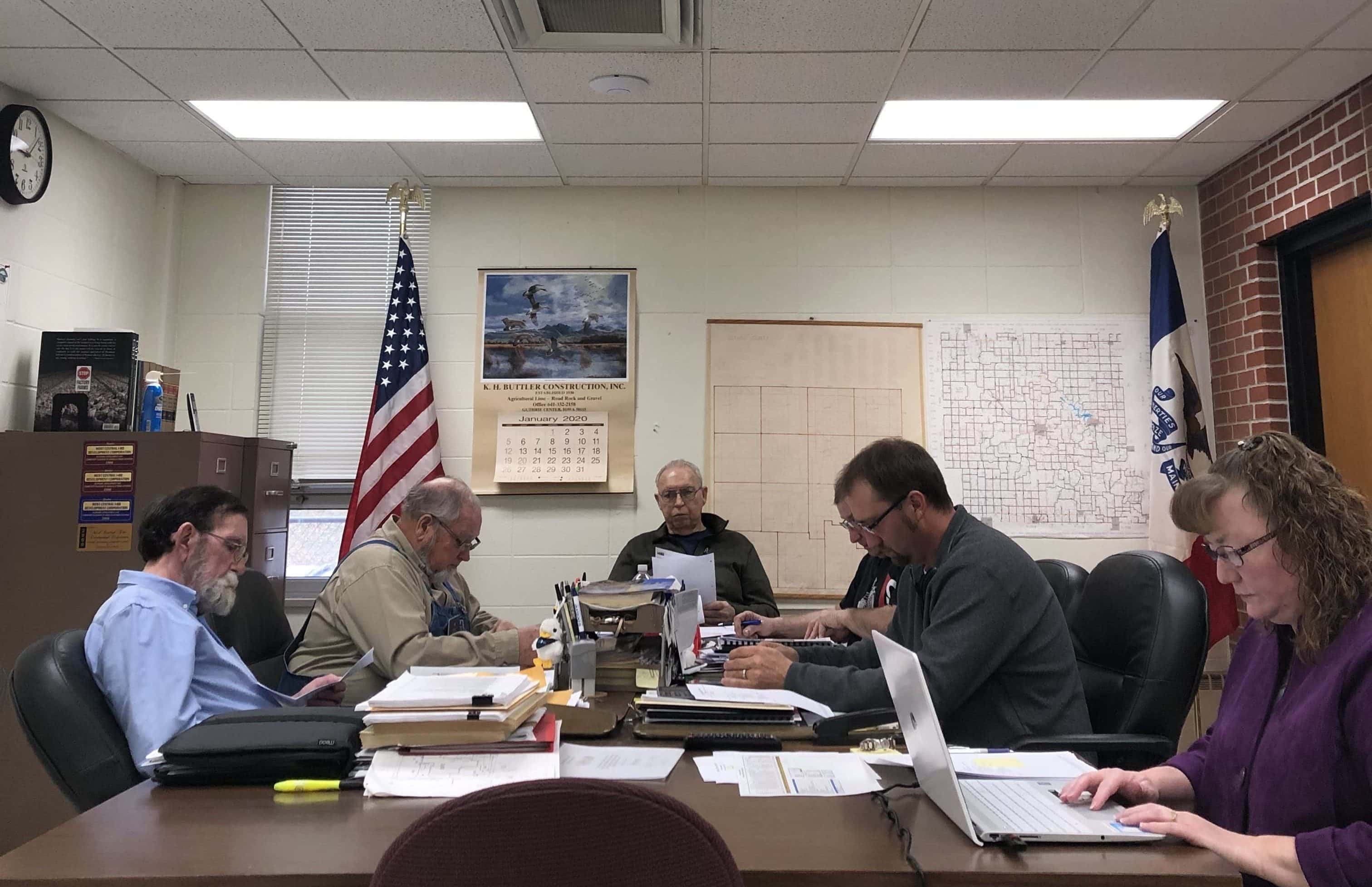

Taxable valuations were presented at the Guthrie County Board of Supervisors’ meeting Thursday, showing a total net decrease of 2.14% in the assessed valuations to about $1.34 billion with an 8.44% increase in taxable valuation to about $834 million. This includes an 8.02% increase in assessed valuation for residential with about $787 million, and a 3.6% increase in taxable valuation with almost $375 million. Industrial saw the largest increase with 62.27% to about $72 million in assessed valuation and a 66.87% increase to a little over $60 million taxable. The largest decrease in assessed valuation was ag land with 24.96% to almost $350 million, with an 8.97% increase in taxable valuation to about $285 million.

County Auditor Marci McClellan pointed out that the general basic fund increased by 8.44% to $3,087,091. While this is not the final proposed property tax rate, McClellan explained that due to legislative changes last year, the County will have to have an additional public hearing to present valuation numbers, and a two-thirds majority vote will be required to approve a property tax levy rate that generates a revenue increase of 2% or more.